From weather extremes to market fluctuations, smallholder farmers across the world face many complex challenges. Agtuall, alumnus of the European Space Agency’s business incubation programme (ESA BIC Noordwijk), has made it its mission to help de-risk and protect these farmers by easing access to insurance products. The startup has developed an innovative platform that offers climate analytics for risk mitigation assessment. It is designed by insurers for insurers, redefining agricultural insurance by closing the long-standing data access gap. We talked to CEO Vikram Sarbajna about Agtuall’s development and the importance of taking an ecosystem perspective.

Vikram Sarbajna is successfully bringing his financial expertise to the realm of sustainable agriculture and climate resilience. Having worked on financial products at Rabobank for a number of years, he was familiar with insurance and agribusinesses – as well as the valuable role that satellite data can play in designing relevant insurance products. It was this background that led him to found Agtuall, a Dutch startup offering financial institutions insight into the risks that a particular area faces, such as drought or flooding. It does this by aggregating Earth observation (EO) images from the Copernicus programme’s Sentinel 1 and 2 satellite constellations for real-time monitoring that incorporates artificial intelligence (AI) modelling.

The team developed and tested its climate data analytics platform during incubation and, ever since graduating from the ESA BIC programme in 2024, has been scaling up its product offering – which has been capturing attention globally. Earlier this year, the company was selected by the Climate Policy Initiative to join The Lab for its platform’s price risk option that addresses the challenge of price volatility in agriculture. Agtuall’s CEO has also been on stage and sharing expertise this year at conferences this year from Bangkok (at the Asia Financial Institutions Forum) to Rotterdam (at the AIAG Conference).

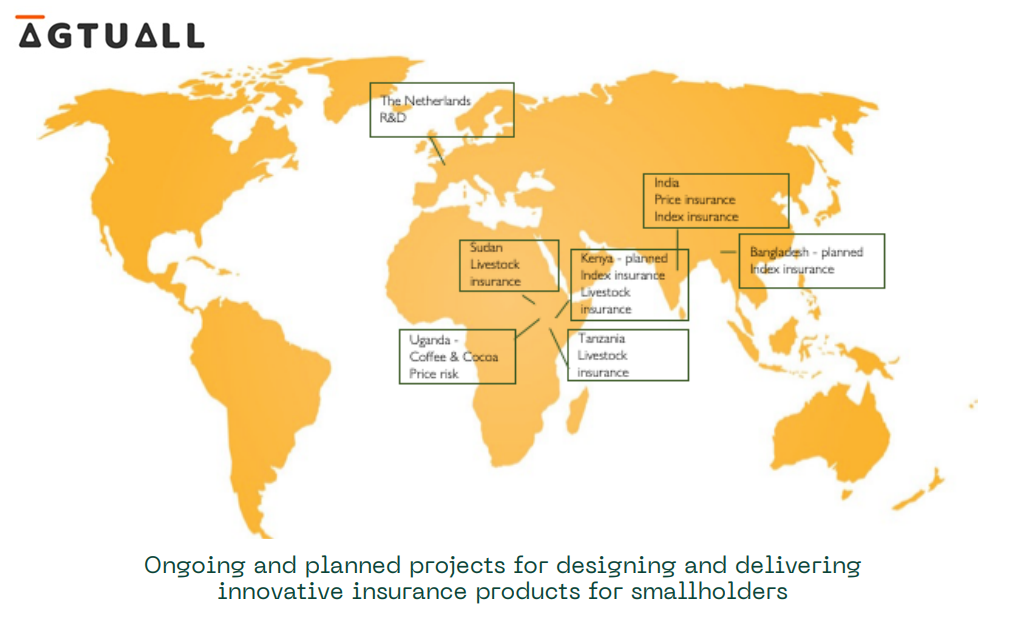

Positioned at the meeting point of financial institutions, agribusinesses, insurers and the farmers, Agtuall has its headquarters in The Hague and is working to contribute to the ecosystems in several countries in Asia (Bangladesh, India) and East Africa (Sudan, Tanzania, Uganda). Here, Vikram shares some insights about his involvement in the ESA BIC programme and the progress of his company.

What problem are you addressing with Agtuall’s technology?

Essentially, we are trying to de-risk smallholder farmers. Due to various uncertainties, farming is a risky activity with two main types of risk: production and market.

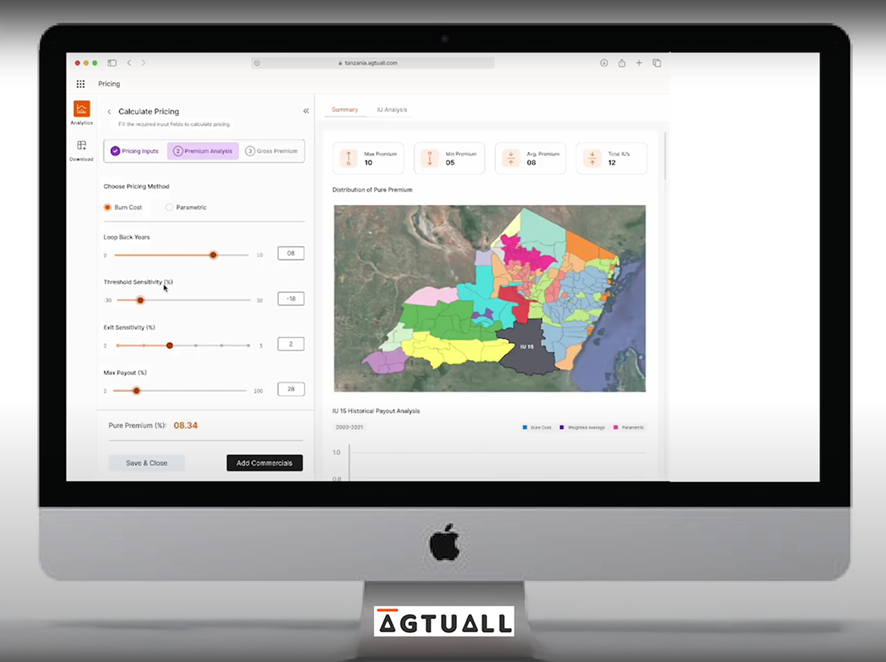

During production, farmers are at the mercy of the weather – not enough rainfall, temperatures or humidity that might be too high – with added environmental factors too (such as pests, etc.). All of this will ultimately affect the yield of the crop that you are growing. Market risk then comes into play; when selling your crops, the market might not be favourable and prices can fluctuate. With Agtuall, we felt that there was a need for more affordable, accurate and good quality de-risking instruments in the form of insurance products to help the farmer manage the processes. So, we designed an innovative platform incorporating satellite data, which allows us to offer affordable agricultural risk assessment insurance. The platform combines cutting-edge AI crop yield models with scenario testing to deliver precise, personalised premium pricing that reflects each farm’s unique risk profile.

How did you develop this concept?

Initially, I was working at Rabobank on the technical side. During my time there, I was inevitably exposed to food and agri topics. That work inspired me to do more on the smallholder side on my own. I opted for smallholders, specifically, because it represents a large segment of farmers who contribute significantly to the food production for the entire world. Yet when it comes to de-risking instruments, there’s a large gap in terms of protection provided. These farmers are also one of the most vulnerable global communities. If you’re looking, for example, at a large farmer in the US or the Netherlands, there are technical innovations already available for them. In other places, there is no safety net for smallholder farmers. For those men and women, one small effect to the yield suddenly has a big impact on their income. Of course, it’s also a big market. Crop insurance as an industry, it is growing, there’s more need for it. So, it was a combination of both – wanting to protect this particular segment and the second more commercial driver. Our approach is built on innovation and empathy, bringing together data science, climate modelling and actuarial expertise to create solutions that are as precise as they are practical.

“Our approach is built on innovation and empathy, bringing together data science, climate modelling and actuarial expertise to create solutions that are as precise as they are practical”

Vikram Sarbajna, agtuall CEO

How important is collaboration in your ecosystem approach?

Our work with the smallholder farmers is always in combination with big players. We still, for example, work a lot together with Rabobank’s impact fund – the Rabo Foundation – that helps us a lot and we are also working with Rabo Partnerships. You always need someone on the banking side to provide loans because these smallholders need funds to develop their farms, adopt new regenerative agricultural practices or invest in higher quality seeds. Then, you also have agribusinesses as a category. That could be, for instance, a market player who buys the produce from the farmer or a seed company selling seeds. We say that we are solving this problem for a smallholder, but we can only solve these problems with an ecosystem approach – there’s always a bank involved and an agribusiness involved, and then the ultimate beneficiary is the smallholder.

What was your focus during incubation to develop the digital tools that power your platform?

Initially, we wanted to create a digital platform that basically supports insurance companies with the design of insurance products for smallholder farmers. Our proposal to ESA BIC was that we wanted to first design it and create a prototype and then perhaps even deploy it in a real-life case throughout the programme period. And we were very successful in doing that. We essentially created that platform, tested it with some paying customers, did a real-life pilot. That’s what we are now scaling. You can keep on designing these things but if you’re not engaging with your end customer and you’re not getting real-life feedback on it, then it becomes yet another technical product that you keep building just for your own amusement.

Did you already intend on using space data before participating in ESA BIC Noordwijk?

Yes, we were already planning on that as it’s a key aspect of our solution. It’s not a new thing to use satellite data to design insurance products. It has been done everywhere, not only for smallholders but also big farmers. The new question we asked was whether we can automate this. We wanted to find a way to make working with this satellite data easier, putting the different satellite and weather data streams together in one platform. During the ESA BIC incubation, we built on that and developed EO insights for smallholder farmers’ many varied requirements (the farm size difference, multiple crops, etc.). By collecting it all and integrating it into our platform, the time to create the insurance products was drastically shortened. The product is now positively impacting farmers’ livelihoods in various countries, including coffee growers in Uganda (pictured above).

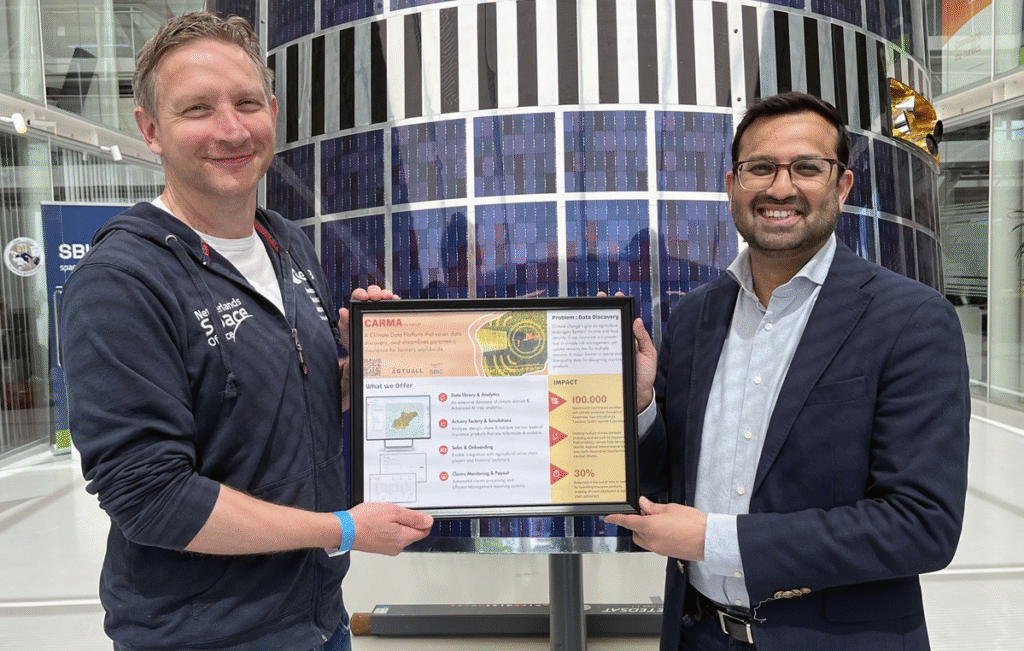

What was the added value of the ESA BIC programme for you?

We got help improving the EO insights and received advice on the further development of our technology. Though, it was the connections we made that really stand out to me, both externally and internally. The programme introduced us to some valuable ecosystem players, for example, the Netherlands Space Office (NSO) – and we still get support from NSO in certain formats. We receive invites to events with themes that are very relevant to us, such as the NSO-initiated Indian delegation visit to SBIC Noordwijk and the sustainability-focused event with business leaders at ESA ESTEC. Those connections helped us a lot with getting to know who else is working on the same problem and what kind of support is available.

On the internal side, we really appreciated the interactions with the startups who did the ESA BIC programme at the same time as us and I still am in touch with a lot of these. It’s really valuable because as a startup, having just established the company, there are things like administrative matters that you might need help with. You can just explain what challenges you are facing to a fellow founder and share experiences. You get a quick answer. Incidentally, there were also a couple of startups in our cohort who were also working on agriculture and looking at small-scale farmers. This community and these connections really were a big plus during our incubation. Also, the financial support provided a nice cushion to be able to do the research and development. The programme gave us the real impetus to develop the platform and get it moving.

Bearing in mind your financial background, would you encourage non-space tech entrepreneurs to apply to ESA BIC?

I would go to the extent that ESA BIC is especially attractive for someone who doesn’t come from a space background. For an outsider, the space ecosystem can be daunting. Right from understanding the complexity of the technology to introductions to the various networking organisations. ESA BIC offers an excellent springboard for a founder with no space tech background.

What are the major learnings from the incubation?

It is important to be realistic because it’s always going to be slower than you anticipate. In the beginning you make a plan and then those plans change – things are going to get thrown at you in between, projects are not going to take off. We were doing a project in Sudan, for example, during the incubation period, where we were providing data and access to the platform. We were designing it to do livestock index insurance for pasturalists and then, midway, a civil war broke out. So, the entire project just got halted. We did finish it ultimately but we had to recalibrate. So, during the incubation period we learned that you need to have contingency plans. As a startup, you need to have plan B, C and D. Otherwise, you won’t move forward. You can get stuck.

Were there other major accomplishments during your time at ESA BIC?

Our plan was to initially just get live testing done but we ended up with live testing as well as paying customers for our platform. This was a major achievement. We now even have a partnership with one of the largest insurance intermediaries in Africa who is using the platform to further scale more insurance products. We exceeded our expectations with the support of ESA BIC, with many developments that were not part of the original plan. It was a very nice thing for us because it helps us scale further.

Are there any collaborators or external parties that have been particularly helpful along the way?

InnovationQuarter gave us an early boost by referring us to the SBIC team that manages the ESA BIC programme, which really accelerated our journey. NSO has supported us in scaling, while the Rabo Foundation has been instrumental in helping us commercialise our product. We’ve also formed key partnerships with financial institutions like Samunnati and Arya Collateral in India, which are critical in reaching smallholder farmers on the ground.

What have you been focusing on since graduating from ESA BIC in 2024?

Our focus has been on scaling the platform, onboarding more customers and improving it technically. We’ve realised that taking an ecosystem approach is critical for us to scale. During our incubation period, we were still thinking only of our customers – insurance companies – that we needed to approach. However, since then, adopting this approach has been a huge learning. We work together with the different key players, like the Rabo Foundation, to get these products out on the market – and we are scaling our platform further in several areas.

What countries have you been deploying your platform in?

We are scaling in India. Earlier this year, we had a big milestone in embedded insurance that we launched with a financial institution. Previously, we were already engaging with insurance companies. We have also started providing data through our platform to insurers in Bangladesh. And the third one is a very good partnership with one insurance intermediary in Kenya. Through them, we have been slowly expanding the number of countries that we add and the crops that we do in terms of protecting smallholder farmers.

Since becoming an ESA BIC alumnus, have there been any key moments?

The big partnership we signed with one of the key insurance intermediaries in Kenya was definitely a highlight. It gives us access to a lot of farmers. Secondly, the fact that we are providing data for Bangladesh because that is one of the countries where smallholders are really vulnerable. A third highlight was us being invited by the United Nations Development Programme (UNDP) to take part in a global panel in India at the beginning of last year, where we showcased our platform. Being asked to present and share our learnings is a big validation of the work that we are doing.

What are the biggest challenges you are facing?

Funding is always a challenge for startups, but one of the bigger hurdles we face is building an effective ecosystem. Supporting smallholders requires more than just our solution – we need to work closely with financial institutions and agribusinesses. Finding the right partners and aligning on a business model that works for everyone is tough, and it’s not a one-size-fits-all. Every country, crop, and context is different. The real challenge is scaling this – replicating partnerships and adapting our product to support a wide range of stakeholders.

How do you handle having a team that largely works remotely in different locations?

I am very happy with the setup we currently have with remote working. Of course, you do need regular get-togethers with the team. For example, our team is mostly in India, so we meet up every quarter to review everything and tackle challenges we are facing. I personally do not believe that you need to come to the office every day and do things physically. I think that era has passed. Although I do see some big companies shifting towards that model, I don’t believe that employers are actually waiting for that model to come back. It Working remotely gives you so much flexibility and is very efficient. With regular check-ins with the team, it works very well for us.

We do still like to engage with clients in person. For example, the first couple of times we believe a physical meeting helps, then you can get a better understanding of the situation and the context. After that, our work with clients in Asia and East Africa takes place virtually for 80 to 90 per cent of the time. So far, this has worked great.

What does the future hold for Agtuall?

Right now, fundraising is a key focus for us. We’ve been deliberate in waiting until we had real traction – clear signs that we’re solving a problem that people are willing to pay for. We believe that’s the right moment to raise. Now that we’ve reached that point, we’re planning to engage with investors over the next 6 months, gather feedback and find the right fit. We’re also looking to grow our team in the Netherlands, scale the product further and build more strategic partnerships – especially with financial institutions, insurers and agribusinesses.

Want to follow Agtuall’s journey and discover the full product portfolio? Reach out to learn more.

ABOUT: Agtuall’s mission is to provide comprehensive risk protection for smallholder farmers. Combining Earth observation data, climate modelling and professional expertise, the company’s platform enables insurance companies to create individually-tailored products for some of the most vulnerable farmers internationally. Since graduating from ESA BIC Noordwijk in 2024, Agtuall has closed contracts with relevant industry players in India, Bangladesh and East Africa. agtuall.com

Open call for startups with space business ideas to apply to ESA BIC Noordwijk:

Related: