OpenAtlas delivers custom-fit solutions for deforestation monitoring. The startup is building tools for complex remote monitoring challenges by combining satellite imagery with artificial intelligence (AI) and machine learning. With ongoing developments in the European Union’s deforestation regulations (EUDR), businesses with globally-distributed supply chains need to be able to prove their compliance. OpenAtlas enables the geospatial analysis required for EUDR and, since joining the programme of ESA’s Dutch business incubator (ESA BIC Noordwijk), has reached major milestones. We caught up with co-founder Harry Marshall to hear about taking supply chain visibility to new levels.

OpenAtlas is on a mission to make advanced geospatial analytics more accessible, efficient and cost-effective for businesses worldwide. Its innovative monitoring solutions ensure accurate analysis, using multi-spectral satellite imagery and the leading edge of deep learning models. A full range of tools leverages the power of remote sensing to monitor, assess and analyse across global supply chains – including agricultural operations, deforestation, construction and many other processes.

The startup is led by Harry Marshall (CEO), with a background in technology, sustainability and entrepreneurship, and Ezekiel Barnett (CTO), who is a geospatial machine learning researcher. After founding the company in 2023 and since joining ESA BIC Noordwijk in January 2025, the team has been busy developing its tools and building partnerships with regulatory service providers linked with traceability and ESG (environmental, social and governance). Harry has also been firmly establishing himself as a go-to voice for EUDR compliance while building a 12K following on LinkedIn. He shares more about his journey in this interview.

How do you describe your startup to new audiences?

We take supply chain visibility to new levels with geospatial analysis – from satellite to solution. So, we are using satellite imagery and machine learning models to monitor for deforestation in supply chains for regulatory compliance. I like to say that we are using geospatial analysis to see the forest from the trees.

How did OpenAtlas come to be?

My co-founder and I met when we were both studying in Berlin in 2017 and then we both ended up moving to Amsterdam in 2019. He is a geospatial machine learning researcher so he’s always been doing stuff with satellites and looking for different things around the world in different contexts. He saw this [EUDR] regulation on the horizon that has geospatial verification at its core and he approached me. He said, “I think I can build a product,” and I said, “I think I can build a business.” That’s how it started.

What problem is your solution addressing?

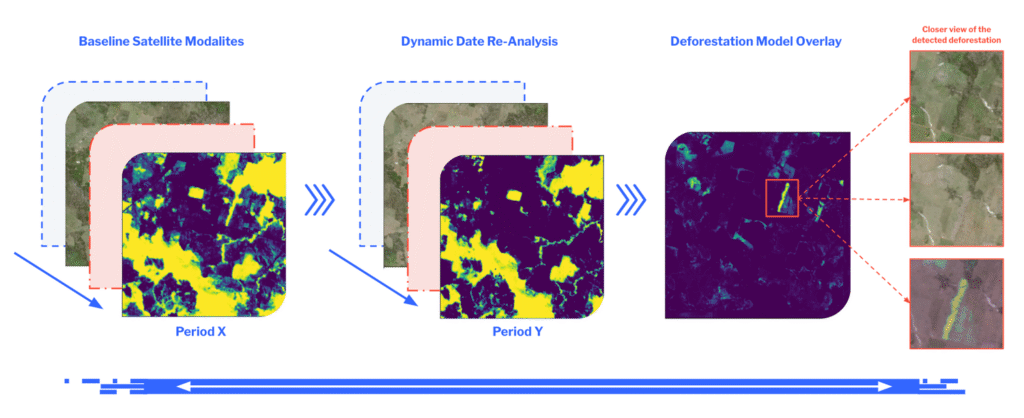

We are making EUDR compliance easier for businesses with large globally distributed supply chains. Due to the fact we’ve built the solution from the ground up for the regulation instead of taking an old solution and applying it to the regulation, it has allowed us to create a very tailored portfolio. I like to then ask the question: How do you look back in time and prove what’s been happening on a plot of land on the other side of the world? This is where remote sensing comes in. With historical satellite imagery, we can do “as-was” and “as-is” comparisons to assess deforestation for regulatory risk. And our product for assessing deforestation – Vantage – is really pointing towards that. Obtaining historical verifiable evidence gets challenging if you are relying on one person to sit behind a desk and look at the data – that would be inaccurate and not scalable to the size of a global supply chain. So, remote sensing technology combined with the most advanced machine learning methodologies allows us to do it accurately at scale.

What’s your approach?

Our customer is any in-scope business of the EUDR but we are not targeting the end customers. We particularly focus on go-to-market via partnerships with regulatory service providers, that way reaching intermediaries by plugging into the tools that supply chain sectors already use. This approach has allowed us to build an API architecture that is really well suited for these businesses and can be incorporated into their own traceability platforms. Automation reduces the historically manual effort required for analysis and enables the processing of large volumes of data to provide timely identification of deforestation events.

What happens if the regulation changes?

Yeah, regulation risk is a big one. We’ve been working to serve this regulation since last year and then it was delayed 12 months – which I think is honestly a good thing as no one would have been ready. Even this year, we’re exposed to the risk that it could move again. My commentary on this is it’s really good developing a selling solution around regulation because business is needed but it’s also quite bad because they only need it when they need it, right? So, we’re kind of trying to endure that period now. Our partners have a lot of customers that are waiting to see what’s going to happen and that could be seen as prudent but it seems very likely that it’s going to come into effect at the end of this year. I think if they wait until after summer there’s going to be a huge crunch.

EUDR explained: Under the regulation, businesses have added due diligence responsibilities and obligations. The EU deforestation regulation (EUDR) compels in-scope businesses to undertake complex due diligence measures to identify and address the risks associated with deforestation and forest degradation within their supply chains. This includes: scientific description of product/quantity/country of production; geolocation of plots of production/date range of production; verifiable evidence that a product is deforestation free; and verifiable evidence that a product is legally produced. Discover more

How are you mitigating that risk?

We’re evolving and expanding from being purely regulatory to a broader supply chain intelligence product. We realised that big brands don’t just lack visibility at the source – they’ve got no visibility about what’s going on between the raw producer and the manufacturing plant. At the moment, they rely on unverifiable data. So, increasingly, we’re developing our products so we can verify those claims using remote sensing technology.

Is your solution applicable to any sector?

Yes; our tools are suitable for different supply chains, it doesn’t really matter whether it’s coffee or rubber and it can be anywhere around the world. So, the solutions are geography and commodity agnostic. That’s the cool thing about satellite imagery – so long as a satellite flies over it, we can do the analysis.

Can you explain further about the space connection?

Our solutions leverage advanced space technology – specifically satellite imagery from the European Space Agency’s Copernicus Sentinel-2 constellation – for most of our EUDR analysis, which is great because it’s the infrastructure underneath what we do and we get to work closely with the people who are like running that as well. So, we can efficiently monitor vast global areas, diminishing the need for ground or aerial surveys. Our proprietary deep learning model has been trained to automatically analyse satellite imagery and detect deforestation patterns globally and at scale.

Get financial support (€60K funding) to help launch your space business >>

How did you first hear about the ESA BIC programme?

I found out about it from another incubatee. I had originally met Olivier from HallTech on the Y Combinator co-founder matching site and by the time we had like he reached out, we were both doing our own things but we met up for a coffee and had a chat and really got along. By that stage, we both had co-founders who were very technical and I think we were a sort of support network for one another because we were both doing all the business stuff ourselves, kind of isolated. He applied for this programme and then he put me onto it. That’s how I ended up here as well.

What are you initially focusing on during incubation?

From a technology perspective, we’re busy improving the solution and developing new layers that contribute to better analysis. For instance, in edge cases – where forest borders meet plantations, hilly terrains or degraded zones – we are refining our models to get more confident about those scenarios. Even though our product is already commercially deployed, we want to keep pushing toward excellence. It’s about continual iteration – making the product even better, especially as we scale.

On the business side, what we’re trying to accomplish is secure those big customers that exist around the EUDR. Building those relationships through our partners is a priority and trying to convert those into real traction as regulation deadlines approach. I’m waiting for them to come online and solidify our market share.

What other innovations are in the pipeline?

We are currently developing a biodiversity index. While the EUDR focuses on deforestation, it’s ultimately about protecting biodiversity. So, we’re building a tool that doesn’t just look at forest versus plantation, but actually tries to quantify shifts in biodiversity. High-biodiversity forests shouldn’t be replaced by low-biodiversity plantations, and this index can help flag those transitions. It adds another important layer to our analysis.

How do customers access your product? Is there a user interface?

We don’t have our own front end. We connect via API to our partners’ platforms. They already have user interfaces their customers use, so we just plug in. We think this is a much more efficient way for data management – no need for data transfers between separate platforms. We feel that two companies coming together – us and a partner – who are both doing their separate things very well, is a better approach. It all fits with our philosophy: instead of being an all-in-one Swiss army knife (that does a lot but not very well), we want to be a best-in-class, purpose-built tool.

What else is beneficial about your partner go-to-market strategy?

It is mutually beneficial. We can have lots of different partners with no one partner being big enough to monopolise us, otherwise they would build their own service, right? Most of our partners don’t want to do what we do. They’re focused on traceability or data aggregation, and we provide a geospatial layer they can’t build themselves. We collaborate well and have built strong, collaborative relationships with their teams. This approach is also advantageous for us because there’s no need to interact with all the customers individually nor do we rely on partners to report usage. We monitor it ourselves, just like a utility company tracks electricity use. Every time a partner platform receives input requests for our tools, we measure the job output based on the hectares analysed and bill accordingly.

And are you focused only on partner-led growth?

We are still actively expanding our network in our partner go-to-market. Via one of our partners alone we do analysis for brands like Adidas, H&M, Hugo Boss and Primark and it would be pretty hard for me to win one of those customers on our own. That said, we’re increasingly engaged with the large enterprise brands themselves – who are big enough that they can plug directly into our API; for instance, Carrefour and Ford – very large organisations with big technology stacks as well. We’re open to that but most of our efforts go into partnerships.

On the reporting side, what does the data delivery look like?

Users send areas and timeframes; then, we run analysis and return raw data (e.g. forest cover, overlap with protected, etc.). We can then provide visualisations for satellite imagery comparisons from 2020 to 2025. The data and model analysis identifies the different forest types and then sees how that’s changed over time – with any deforestation signaling as well.

There sometimes can be a misunderstanding that we’re acting like the police but we’re not. We are just verifying that people have done the right thing in terms of compliance – we’re not catching wrongdoing. In many cases, suppliers or producers have owned the land for 20 years and if there was ever a forest there it was a long, long time ago. If it wasn’t forest by the regulation’s cutoff date – 30 December 2020 – then they’re fine. Our role is to provide verifiable evidence of that. Though to be clear, not all forest loss is non-compliance and not all forest cover is deforestation-free: context is key.

By the end of your incubation, what’s your target?

So, what we’re building towards is the biodiversity deforestation deployment. I think that will take us up to the end of the year pretty well when the regulation comes into effect. At that point, we’re already looking at how to do this broader supply chain analysis as well. I think having that all fully built out, packaged and set is the goal. As well as having high confidence in that analysis.

What aspects of the ESA BIC programme are you appreciating most?

Talking to the other founders is the most valuable thing. They’re all on similar journeys, in different ways, with so much shared experience. Even if our businesses are totally different, there are aspects that are similar. It is cool to hear the challenges that people are having and there’s a few other Earth observation companies, so we can kind of compare strategies. The discussions with those who are doing completely unrelated things but facing similar abstract challenges is something I really love. We’ve had some great exchanges with all the founders, especially with those who are more technical, since I come from a business background and feel there is real value in helping out in these sessions.

I’m getting involved in everything I can – events, workshops, sharing knowledge – it’s all part of the experience. That energy and openness in the community is something I’ve really enjoyed. We’re also looking forward to making use of the technical support that is available and we’re still looking into the options. I think the biggest external benefit of being part of ESA BIC is the brand is super strong people respond very well to ESA. And I’m sure that’s just the tip of the iceberg of the value that exists here.

Our solutions are geography and commodity agnostic – so long as a satellite flies over it, we can do the analysis

harry marshall

Are you raising funding during the incubation?

We’re not actively engaged in raising funds but we’re not closed to it either. We’re at a good stage right now. I think where we get to by the end of this year will shape our next steps. Having said that, if the right opportunity arises, we’ll consider it. Of course, I’m always happy to get on stage and pitch to investors at climate tech events – it’s always great for visibility and it’s good practice if nothing else.

What is your long-term vision beyond deforestation?

Our future ambitions lie in broader supply chain analysis. During our work in the EUDR space, we’ve uncovered that there’s no visibility in the supply chains between the producer and the European brand distribution. We are uniquely positioned to make that less of a mystery by shining a light and using remote sensing technology to ensure more supply chain transparency. If you’re doing the right thing from an environmental perspective, you should be recognised for it. If you’re not, you shouldn’t be able to hide. We believe this can help address greenwashing, regulatory risks and misreporting – ensuring good actors get the recognition and bad practices are not rewarded.

And finally, what’s your favorite thing about space?

I love how space makes you feel small – but in the best way. It just puts everything in perspective. If I’m stressing about an email or a decision, I remember that in the vastness of space, it’s not such a big deal. And honestly, I used to work in fintech but at dinner parties nobody was terribly interested. Now, it’s pretty cool being in a job where you get to say, “Yeah, I work with satellites.” And the fact that we help the planet as well is a nice thing to sleep on every single night.

ABOUT OPENATLAS

OpenAtlas is a remote sensing company established in 2023 that helps businesses navigate compliance with the EU deforestation regulation (EUDR). Its flagship tool, Vantage, uses high-resolution Sentinel-2 satellite imagery combined with deep-learning models to detect land-use changes and assess deforestation risk. The startup’s solution offers near real-time coverage of global land surfaces with tools that ensure regulatory decisions are based on what’s actually happening on the ground, not just what’s reported on paper. It’s actionable, audit-ready intelligence. open-atlas.com

Validate your business plan and space connection!

Refine and validate your space business idea via the space connection assessment takes place as part of your preparation of applying to ESA BIC. Want to find out more? Meet the team & get your questions answered: